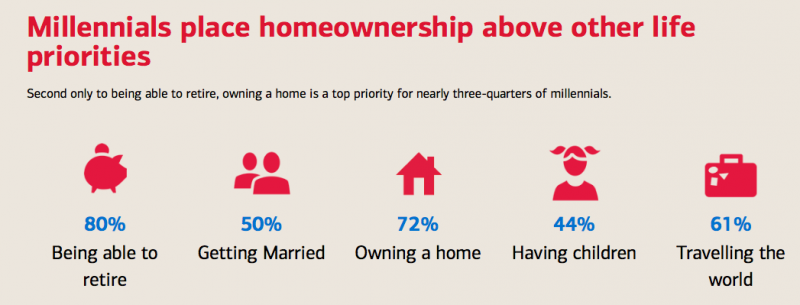

First comes the house and then maybe marriage or children, according to surveyed millennials detailed in Bank of America’s 2018 Homebuyer Insights Report, which was culled from 2,000 consumer responses. The survey finds that 23- to 40-year-olds value homeownership above nearly everything else: 72 percent call it a top priority compared to 50 percent who say getting married or 44 percent who say having children are top priorities. “Being able to retire” topped homeownership in the survey at 80 percent.

Most millennials equate homeownership with personal and financial success, the survey finds. They also say buying a home makes them feel mature (47 percent); act like an adult (47 percent); and feel independent (36 percent).

“Younger generations tell us that owning a home has become a milestone that defines their success, and it’s promising to see them aspiring to homeownership,” says D. Steve Boland, head of consumer lending at Bank of America.

Renters seem to be upbeat about buying, too, but several obstacles are delaying their plan. Nearly 50 percent of renters surveyed say they believe renting long-term will prove to be more expensive than buying a home, and 69 percent believe their rent will continue to increase every year or every other year. Renters acknowledge that their finances, however, are the top barrier to homeownership, citing the lack of down payment funds or not being able to afford the home they want as the biggest obstacles. Also, some myths to homeownership may be preventing renters from taking the plunge into homeownership. Forty-nine percent said they believe they need a 20 percent down payment to buy a home and nearly one in four believe they need a “perfect” credit score to qualify for a mortgage.

Source:

“2018 Fall Homebuyer Insights Report,” Bank of America (2018)